Explore Solutions

Find The Right Solution For You

Whether it’s consolidating debt, settling for less than you owe, or eliminating your debt entirely, we’re here to help you make the right decision for your unique situation.

Consolidation Loan

Simplify Your Debt

Combine your debts into one manageable loan with lower interest rates and a single payment.

Debt Settlement

Reduce What You Owe

Negotiate with creditors to settle your debt for less than what you owe, making it easier to pay off.

Debt Validation

Verify Your Debts

Ensure your debts are accurate and valid, potentially reducing or eliminating what you owe.

Home Equity Loan

Tap Into Your Home's Value

Use your home equity to secure a loan with favorable terms and pay off high-interest debt.

Mortgage Refinance

Lower Your Mortgage Payments

Refinance your mortgage to reduce monthly payments, freeing up cash to tackle other debts.

Bankruptcy

Start Fresh

Explore bankruptcy options to discharge debts and start rebuilding your financial future from a fresh slate.

Whether it’s consolidating debt, settling for less than you owe, or eliminating your debt entirely, we’re here to help you make the right decision for your unique situation.

Combine your debts into one manageable loan with lower interest rates and a single payment.

Negotiate with creditors to settle your debt for less than what you owe, making it easier to pay off.

Ensure your debts are accurate and valid, potentially reducing or eliminating what you owe.

Use your home equity to secure a loan with favorable terms and pay off high-interest debt.

Refinance your mortgage to reduce monthly payments, freeing up cash to tackle other debts.

Explore bankruptcy options to discharge debts and start rebuilding your financial future from a fresh slate.

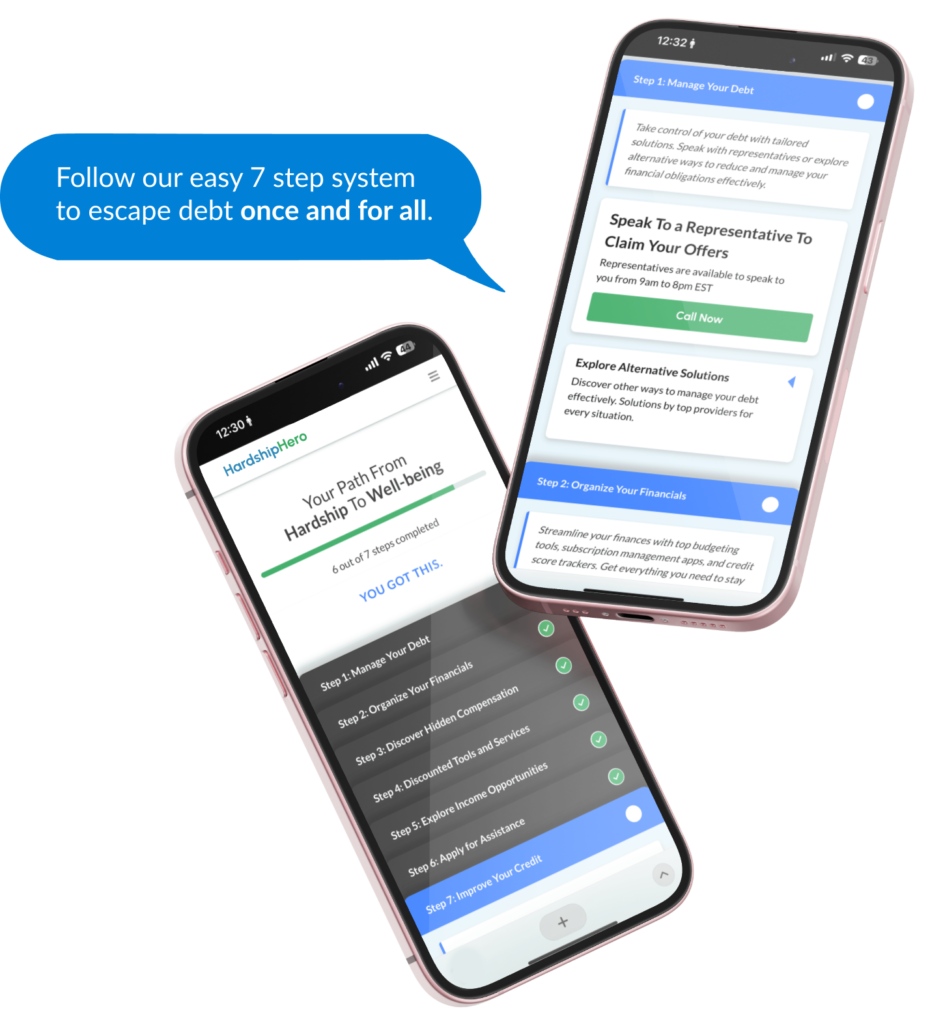

Get loan offers, hardship solutions, financial guidance, income opportunities, and exclusive offers to get you out of debt—all within one simple application.

*Applying will not affect your credit score

Combine your debts into one manageable loan with lower interest rates and a single payment.

Negotiate with creditors to settle your debt for less than what you owe, making it easier to pay off.

Ensure your debts are accurate and valid, potentially reducing or eliminating what you owe.

Use your home equity to secure a loan with favorable terms and pay off high-interest debt.

Refinance your mortgage to reduce monthly payments, freeing up cash to tackle other debts.

Explore bankruptcy options to discharge debts and start rebuilding your financial future from a fresh slate.

Receive expert recommendations that match your unique debt profile, helping you find the best path to financial freedom.

Discover various ways to increase your earnings with personalized recommendations based on your financial situation and interests.

Track your debt reduction journey in real time with easy-to-read visuals that keep you motivated and focused on your goals.

Hardshipfinancial helps you explore debt relief and financial solutions tailored to your unique situation. We offer access to loans, debt resolution, and other programs designed to help you escape debt for good.

No! Our application process is quick, simple, and takes only a few minutes. You’ll receive personalized recommendations right away

Yes! We work with a variety of services that may be able to help, regardless of your credit score. Don’t let bad credit stop you from applying.

We offer a range of services, including Consolidation Loans, Debt Settlement, Debt Validation, Mortgage Refinancing, Home Equity Loans, and Bankruptcy solutions.

Absolutely. We use industry-standard security measures to ensure your personal information is protected.

No, applying through Hardshipfinancial does not impact your credit score. Our service helps match you with options based on your situation.

Once you submit your application, you’ll receive personalized recommendations. From there, you can speak to one of our trusted partners who will guide you through the next steps.

No, applying is completely FREE. We believe everyone deserves the chance to explore their options without any upfront costs.

Yes, we thoroughly vet all of our partners to ensure they provide reliable, effective solutions for people in financial hardship.

If you don’t qualify for a loan, we’ll still recommend other options, such as debt settlement or validation, that may better fit your needs.

Our app is currently in beta as a web version, and for a limited time, we’re offering FREE access to all users who complete an application. Take advantage of this exclusive offer to start managing your debt and financial goals today!

Submit your application now to unlock your free access.